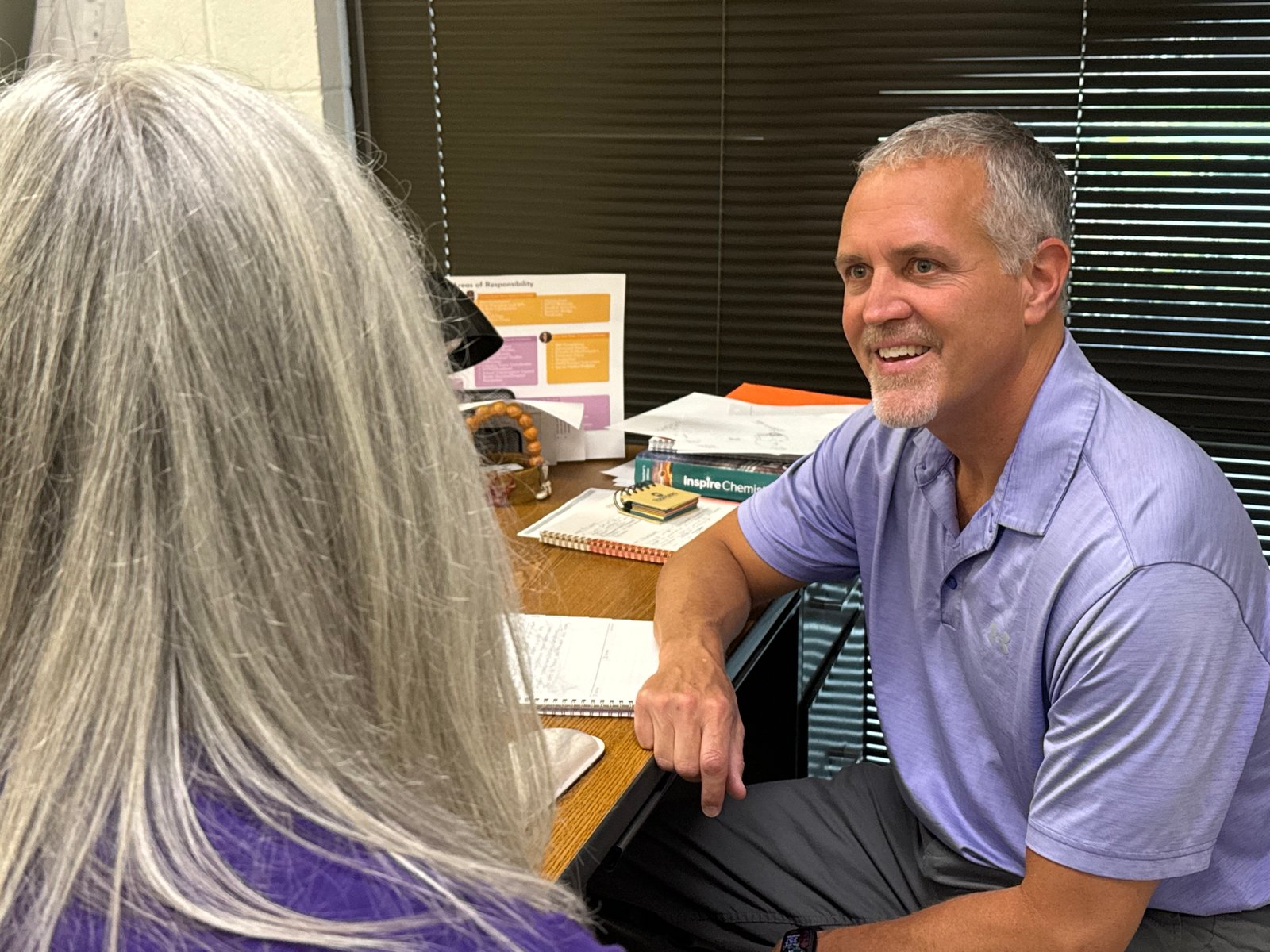

Comprehensive Financial Planning

We partner with you to develop a comprehensive financial plan that aligns with your short and long-term goals. Our ongoing support helps you implement this plan effectively.

Investment Management Services

We create investment portfolios that are consistent with your risk profile and align with your short- and long- term goals.

We provide continuous advice regarding your investments based on your individual needs.

Hourly Planning

Services

Choose any financial planning topic and get a financial plan with detailed actionable recommendations based on these topics.